MI PC 583 2011-2026 free printable template

Show details

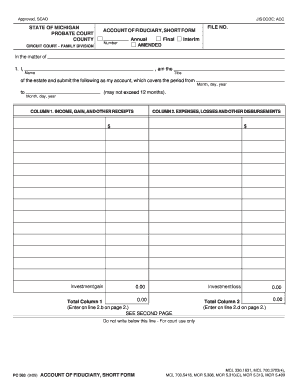

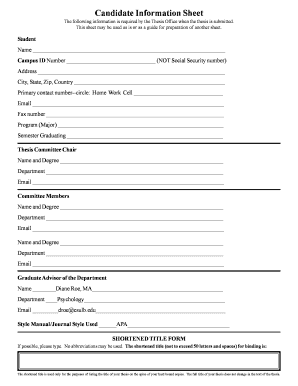

PC 583 (9/11) ACCOUNT OF FIDUCIARY, SHORT FORM. In the matter of. Approved, SCAN ... PROBATE COURT ... being filed in the circuit court family division, please enter the court name and county in the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign account of fiduciary short form michigan

Edit your pc 583 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pc 583 fiduciary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

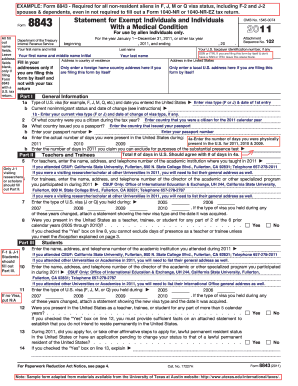

Editing michigan probate form pc 583 online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pc583 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI PC 583 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 583 michigan form fill

How to fill out MI PC 583

01

Begin by gathering personal information such as your name, address, and contact details.

02

Indicate your relationship to the party involved in the case.

03

Fill in the case number provided by the court.

04

Complete the sections related to the specific request or motion you are filing.

05

Sign and date the form at the bottom.

06

Review the completed form for accuracy before submitting it.

07

File the completed form with the appropriate court office, either in person or via mail.

Who needs MI PC 583?

01

Individuals involved in legal proceedings where a motion or request is being made.

02

Parties seeking to modify or respond to a specific court order.

03

Litigants who need to clarify or inform the court about particular case details.

Fill

pc 583 probate

: Try Risk Free

People Also Ask about pc 583 michigan

How long do you have to settle an estate in Michigan?

An estate cannot be closed in less than five months from filing. The estate's creditors must be notified of the decedent's death. They are given a four-month period to file their claims against the estate.

How long do you have to close an estate in Michigan?

The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing.

Do all wills have to go through probate in Michigan?

Michigan Probate Laws require a decedent's assets go through Probate if the assets were held solely in their name. Assets usually don't need to go through Probate if the assets that are jointly owned, the assets have a beneficiary designation, or the assets are held in a Living Trust.

What are the steps for probate in Michigan?

Michigan probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

How do I file a personal representative in Michigan?

If you want to be the personal representative, complete the Application for Informal Probate and/ or Appointment of Personal Representative form. File the form, the decedent's will (if there is one), and a certified copy of the death certificate with the county probate court where the decedent lived.

How long does an executor have to settle an estate in Michigan?

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open. A copy of this notice must be given to all interested persons. 8. Ensure that all taxes on the estate are paid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit scao pc 583 online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your pdffiller and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I make edits in form pc 583 without leaving Chrome?

court 583 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete state of michigan form pc 583 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your short form account fiduciary. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is MI PC 583?

MI PC 583 is a form used in Michigan that allows businesses to report and pay their personal property taxes.

Who is required to file MI PC 583?

Businesses that own personal property in Michigan and are subject to personal property taxes are required to file MI PC 583.

How to fill out MI PC 583?

To fill out MI PC 583, businesses should provide information about their personal property, including details about their assets, and complete the applicable sections as instructed on the form.

What is the purpose of MI PC 583?

The purpose of MI PC 583 is to assess and collect personal property taxes from businesses in Michigan.

What information must be reported on MI PC 583?

MI PC 583 requires businesses to report information such as the description of personal property, the date of acquisition, and the value of the property.

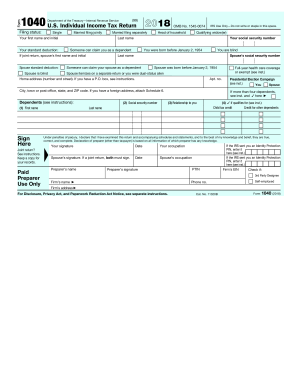

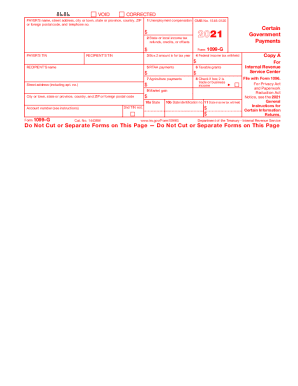

Fill out your MI PC 583 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

583 Probate County is not the form you're looking for?Search for another form here.

Keywords relevant to form 583

Related to pc 583 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.